does texas have an inheritance tax in 2020

For example John passes away and gives 25000 in inheritance to Mary. Gift Taxes In Texas.

Qtip Trusts Help Avoid Estate Taxes Texas Trust Law

There is a 40 percent federal tax however on estates over.

. On the one hand Texas does not have an inheritance tax. The estate tax rate is currently 40. Texas repealed its inheritance tax law in 2015 but other.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. There is no federal inheritance tax but there is a federal estate tax. As of 2019 only twelve states collect an inheritance tax.

Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government. The Texas Franchise Tax. Texas does not have state estate taxes but Texas is subject.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. There is a 40 percent federal tax however on estates over. The federal government of the United States does have an estate tax.

An inheritance tax is a state tax placed on assets inherited from a deceased person. The inheritance tax is paid by the person who inherits the assets and rates vary. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

An inheritance tax is a tax that is charged on the fair market value of assets a person receives as an inheritance. The state of Texas does not have any inheritance of estate taxes. There are no inheritance or estate taxes in texas.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. For 2020 and 2021 the top estate-tax rate is 40. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

The tax is determined separately for each beneficiary who is then responsible for paying any inheritance taxes. However other states inheritance taxes may apply to you if a loved one who lives in those states. 1206 million will be void due to the federal tax exemption.

Fortunately Texas is one of the 33 states that does not have an. However a Texan resident who inherits a property from a state that does have such tax will still be responsible. The state of Texas is not one of these states.

Click the nifty map below to find the current rates. With a base payment of 345800 on the first 1000000 of the estate. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Taxation In The United States Wikipedia

When To Choose Munis From Outside Your Home State Charles Schwab

State Estate And Inheritance Taxes In 2014 Tax Foundation

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

What Is The Probate Process In Texas A Step By Step Guide

I Just Inherited Money Do I Have To Pay Taxes On It

Where Not To Die In 2022 The Greediest Death Tax States

Dealing With Debt After Death Of A Relative Estates And Executors

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Texas And Tx State Individual Income Tax Return Information

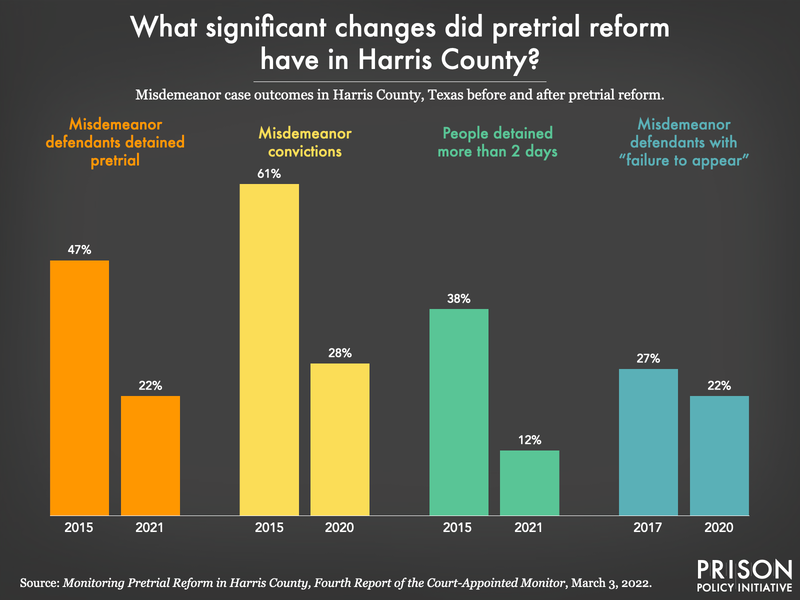

What Does Successful Bail Reform Look Like To Start Look To Harris County Texas Prison Policy Initiative

Estate Tax Category Archives Houston Estate Planning And Elder Law Attorney Blog Published By Houston Texas Estate Planning And Elder Lawyers Mcculloch Miller Pllc

Texas Is Moving Left But The State S Laws Aren T Getting More Progressive The Washington Post

How Will The Changes In Property Tax Laws Affect Texas Landowners Paramount Property Analysts